BUSINESS OVERVIEW OF THE WEB HOSTING MARKET

The global Web Hosting market had an estimated worth of $56.7 billion in 2019 when valued as integrated with cloud services. A report by Grand View Research in June 2020 predicted that the market value was going to reach $62.6 billion by the end of the same year, and with a sustainable growth of 15.5 in the following 7 years, it was estimated to triple by the end of 2027 compared with the figures in 2019. The 2020 COVID-related restrictions, however, proved that the impact of the pandemic on the digitization pace was much greater than it was originally expected. Grand View Research’s estimates of $62.6 billion went beyond $75.3 billion, exceeding expectations by 20.28%. With these new realizations, the expected sustainable growth rate of 15.5% has been revised to 18%. According to a 2021 report by Fortune Business Insights on the next 7-year projection, the sustainable market size is estimated to reach $267.1 billion. In other words, the web hosting market has the potential to grow 2.5 times in the next 7 years.

Regional Market Distribution

Looking at the regional distribution of this gigantic economy, North America, which is home to global giants such as Amazon Web Service, Google Cloud and GoDaddy, gets the largest slice of the cake with a 35.28% share. Europe, on the other hand, continues to challenge the percentage dominance of North America, with a growth momentum half a point above the market expectations (16%), mostly spearheaded by Germany and the UK. Glancing at the Asian region, the growing market under the leadership of Alibaba Cloud has the power of population as its stronghold and is at least as dynamic as its Western rivals. With 90.46% of the total size of the global corporate segment, it takes a huge commercial piece of 19.1 billion dollars.

Shared Web Hosting Marketplace

Between 2015 and 2020, the sustainable compound growth rate of the commercial hosting market size was 14% on average with shared hosting having an $8.5-billion share of the market as of the end of 2020. Looking at the 2026 projections, this market is expected to reach $18.3 billion. According to the June 2021 report by the US-based Global Industry Analysts, the shared web hosting market is expected to grow 1.1 fold when separated from the cloud computing market. The compound growth rate will reach 11.6%, while the commercial size of the Asia-Pacific will display a performance above the global average by reaching $2.6 billion by the end of 2026.

In the shared web hosting market, which represents a 25.5% share of the global web hosting market, the main reason why the compound growth cannot accompany cloud services (18%) is that the solutions addressing the corporate segment remain limited. Because of that, new revenue opportunities must be created in a market in which cost optimization is a major concern when developing new products due to shared resources and service structures.

The Scope of the E-Book

In this e-book, the modelling of growth strategies for all business operations focusing on the web hosting industry and the development of a growth-oriented marketing foundation with regard to target markets are discussed in detail.

The e-book is hoped to serve as a guideline for all initiatives targeting the web hosting market, which has a 2.5-fold growth forecast in the sectoral projections detailed in the Introduction section, as of 2021, the date this book was written.

BUILDING THE GROWTH MODEL

Commercial Model Structure

The Web Hosting industry, along with all its sub-sectors, has a global business model operating with service-based economies of scale dynamics as well as a renewed revenue model which, for the most part, deals with cost models such as “pay-per-use” or “pay-as-you-go”, which do not carry the risk of collection.

Without exception, all industry players in their commercial models adopt the following flow:

Gain Customers > Grow Customer Base > Repeat

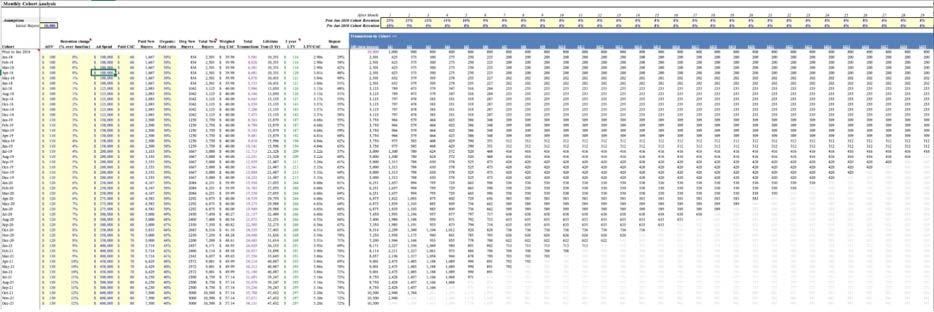

In this respect, many businesses operating in the web hosting industry use Financial Cohort Analysis to track the revenues earned on a monthly basis or generated in the forthcoming months by their customers; that is, to measure the customer lifetime value (LTV), and to calculate customer acquisition costs (CAC) for the customers acquired as a result of marketing investments.

Financial Cohort Analysis: Sample

Financial Cohort Analysis is the most effective method for all businesses that sell time-dependent services and engage in marketing activities to create customer acquisition and product depth, allowing them to closely monitor the performance of their business models.

Financial Cohort Analysis through a Simple Example:

Let’s assume that a business has spent $1,500 to acquire 100 cloud server customers in September 2021. In this case, the cost of acquisition (CAC) per customer is $1,500 / 100 = $15.

Now, imagine that the business provides a cloud server to these customers at a 50% discount for 10 USD for the first 3 months and collects 20 USD from the remaining customers starting from the 4th month.

Again, assuming that the retention rate for these customers is 90% on average at the end of month 3 and 70% within every 3 months when the discounted price ends, we can tabulate the business turnover in the first 12 months using Cohort Analysis as follows:

12-Month Cohort Analysis of September 2021

| First Month | 2rd-3nd Month | 4th-6th Month | 7th-9th Month | 10th-12th Month | At the end of the 12th Month | |

| Customer | 100 | 90 | 63 | 44 | 30 | 30 |

| ARPU | 10$ | 10$ | 20$ | 20$ | 20$ | -$ |

| Revenue | 1.000$ | 900$ | 1260$ | 880$ | 600$ | 4.640$ |

As can be seen from the table, although that the company generated only $1,000 turnover from the 100 existing customers out of the allocated marketing budget of $1,500 (negative ROAS), it actually earned $4640 (ROAS 464%), when looking at the recurring revenues from a 12-month perspective.

Segmentation Structure

Segments commonly used in the Web Hosting industry can be classified under 3 main categories.

1- Segmentation by Product Ownership

In this segmentation type, which is based on fixed product positions, the products are classified based on the needs of different customer groups and their purchasing decisions using the principle of segmentation. In this segment category, customers are matched with interests based on the products they have purchased. For instance, when registering multiple or an above-average number of domains, the customer is included in segments such as “Domainer”, and when purchasing multiple web hosting packages, the customer is included in segments such as “Prosumer”.

Businesses that prefer a segmentation model based on product ownership try to increase segment sensitivity by breaking different customer groups into sub-segments. However, despite being the easiest model to operate, the segmentation model by product ownership is the least successful one as it does not incorporate the variables of “frequency” and “behaviour”.

2- Segmentation by Payment Amount

This model is typically preferred by businesses with a horizontal product portfolio (for example, a cloud-only product line). In this model, the maximum and average amounts paid by the customer in the same cart as well as the total amount the customer is ready to spend in a certain period of time are taken as the basis for segmentation.

In this way, product carts (multiple items in the same cart) or users who are likely to respond to special period-related offers can be targeted easily.

3- Data-Driven Segmentation

It refers to a segmentation with the most sensitive and dynamic structure among the segmentation types.

In the data-based segmentation model, segment variables are predefined and classified. All variables that make up the relevant classifications are scored separately for individual customers. Scoring are updated as customer-generated signals change. The upper and lower customer segments also change in line with every score change.

Data-driven segmentation signals can generally be summarized under the following headings:

- Log-in frequency

- Product page visits

- Email marketing reactions

- Products added to the cart

- Items purchased

- Payment behaviours (such as instalment/cash transaction/cart average, etc.)

- Coupon uses

- Campaign uses

- Consecutive purchases

- Product activation rates

- Product up-to-dateness

Advantages of the data-driven segmentation model include:

- Ability to detect the time of need

- High success in relational marketing communication

- Minimizing turnover erosion

- Effective customer value management

Creating Segmentation Scorecards

All segmentation types are open to scorecard generation. In this way, non-fixed variables such as payment amount can be assigned to the same score group for a certain range, while customer prioritization can be achieved by giving a different score to products with high commercial value in segmentation types based on product ownership.

Scorecards are essentially the backbone of data-driven segmentation. Assigning customer-generated signals to data metrics with correct scoring is a prerequisite for this segmentation model to work flawlessly.

Determination of Base/Reference Values

It is critical to determine base values before generating variable scores. For example, a business that regards the reference value for the time spent on the page as the average duration of successful purchases should also take into account the website load speed by interstitials added to the page (e.g., pop-up offers or live chat apps) by location or device while determining the standard deviation coefficient for this value.

Similarly, a business that scores reactions to email marketing activities should allow for the email’s carrier offers, clicks on offer, page depth of the click-through visit, and flow components of the entire customer journey if it has specific applications such as a cart-free purchase journey.

Reference Value Table: Sample

| Reference Value | Standard Deviation | |

| Visit Depth | 132 sec | %25 |

| Cart Amount | 22$ | %10 |

| Price Sensitive Email Open Rate | %70 | %10 |

Scoring and Weighting

The scoring and weighting of the metrics begin after determining the base/reference values.

Not every component that affects the scoring has to be of equal weight. For example, even if the customer has never clicked on the e-mail, he can show his interest in the targeted products by adding them to the cart and visiting the relevant page several times.

Therefore, on top of determining the weights of desirable customergenerated signals, purchasing and participation rates in product journeys need be taken into account as well. A business that wants to determine a scoring weight for the e-mail activity mentioned in the above example should assign this value by taking into account the e-mail open rates and keeping the “increasing permission-based marketing” heading open in its marketing goals, acknowledging that users who do not allow e-mail marketing within the same setup will always have a negative effect on the determined rate in this scoring system.

Scorecard: Sample

| Ref. Value | Std. Deviation | Weight | Min. Score | Max. Score | |

| Variable A | 220 sec | %5 | %10 | 1 | 10 |

| Variable B | 4 pieces | %25 | %40 | 1 | 10 |

| Variable C | %70 | %0 | %40 | 1 | 10 |

Calculation: Example

Let’s assume a customer has the following scores for product X:

| Customer Signal | |

| Variable A | 230 sec |

| Variable B | 2 pieces |

| Variable C | %35 |

In this case;

As he stays within 5% of the standard deviation, he gets 10 full points for variable A.

His score drops by 33% as the result is 2 pieces while expecting a minimum value of 3 pieces with 25% deviation; hence, 7 points for Variable B.

His score drops by 50% as he generates a 35% signal while expecting a minimum value of 70% with 0% deviation; hence, 5 points for Variable C.

Weighted Score Calculation:

(Variable A Score x 10%) + (Variable B Score x 40%) + (Variable A Score x 40%)

= (10 points x 10%) + (7 points x 40%) + (5 points x 40%)

= 1 + 2.8 + 2

=5.8 Weighted Score

The customer generated 5.8 Weighted Score for product X.

OFFER & CAMPAIGN MODELS

All businesses need new customer acquisition to grow. The growth equation works when the “New Customers – Lost Customers” sum is greater than zero.

Therefore, focusing on new customer acquisition as well as retaining existing customers is strategically important for all web hosting players.

Given the growing nature of this market, every business that combines the right product and price positioning with the correct communication /marketing strategies will most likely get its share of this growth trend. However, this process can be managed more effectively and intelligently using a number of tricks.

Smart Price Propositions:

Low price propositions may not always be effective for new customer acquisition. It may not be possible to set and maintain a bottom price given that all competitors have convergent costs with the same marketing inventories or even similar supplier networks.

Low price competition with no value proposition often has a devastating effect on the market as a whole. Your R&D investments and even your operational flows may deteriorate due to shrinking margins. To avoid this, try creating limited-time offers specific to groups that fuel the market growth trend.

If you are a very new player in the market, your biggest problem will be to build a customer base. At this point, almost all customers who reach you are new users to you, while they may be existing customers of another established competitor. Make sure your offers at this point are centred around value propositions that you believe are the weaknesses of your established competitors.

When determining your new customer pricing policy, determine in advance how much you can allocate for a customer. For example, if you want to acquire customers at a cost of $20, you might consider allocating $12 of that to marketing and the remaining $8 to product cost.

Consecutive Offers:

Encourage users to perform multiple transactions through you by spreading the budget you will allocate for new customer acquisition to consecutive purchase offers instead of a single transaction. In this way, the purchasing experience will gain continuity, and customer product depth will increase at an unexpected rate.

While complementary offers like 50%-off encourage the first transaction on the first purchase and help you cross the big threshold, adopting a strategy like 30%-off that is both competitive and progressive by reducing the price priority on the 2nd and future offers will make it easier for you to use your budget more effectively and reach some of your loyal customer base goals.

Trial Versions:

If you want to enter an established market with a new product or service, or if you aim to generate additional revenue opportunities from your customer base with alternative products, trial versions can help you. Trial versions are products where the main features that allow the use of the product for a limited time or that add qualifications to the product cannot be used.

If you are aiming to create a wave with trial versions, it is critical that you set up the motivators for your product to transition to the paid version. It should be noted that, in many markets that have been penetrated by trial versions where the value proposition has not been established, the product could not have been pushed forward to the post-paid model.

LET’S CREATE YOUR GROWTH PLAN TOGETHER

If you are a new or established web hosting company; you can get support from Cloud Markethink’s professional services to grow in your targeted markets.

What do we do for Web Hosting Companies?

- Strategic Marketing Consultancy

- Product Marketing

- Digital Marketing Management

- Search Engime Optimization

- Social Media Marketing

- Performance Marketing

- WHMCS Optimization

- Website Design

- Software Development

Web Hosting Industry References